By CA Gurjot Singh

Upon operating a business, there are circumstances where you as a registered entity can have some excess balance left in credit ledger on GSTN Portal. There can be various reasons for accumulation of such input credit balance, however, some of the most prominent reasons are :

-

Accumulation due to exports of goods and services made without payment of taxes (Export under LUT)

-

Accumulation due to Inverted Duty Structure (IDS)

-

Due to sales made to SEZ Units/SEZ Developer without payment of taxes

-

Excessive Payment of tax due to some mistake

Steps to file RFD 01 to claim GST Refund

Under GST Law, the balance in Electronic Credit Ledger can be claimed as refund by filing a refund application in the way of Form RFD-01. The process of filing is RFD-01 is online and can be made through the GSTN Portal itself.

Follow these steps and claim your refund under GST Law :-

Step 1:

Login to your GST Portal by entering your User id & Password.

Step 2:

Upon successful login into your account, go to Services > Refunds > Application for Refund

Step 3:

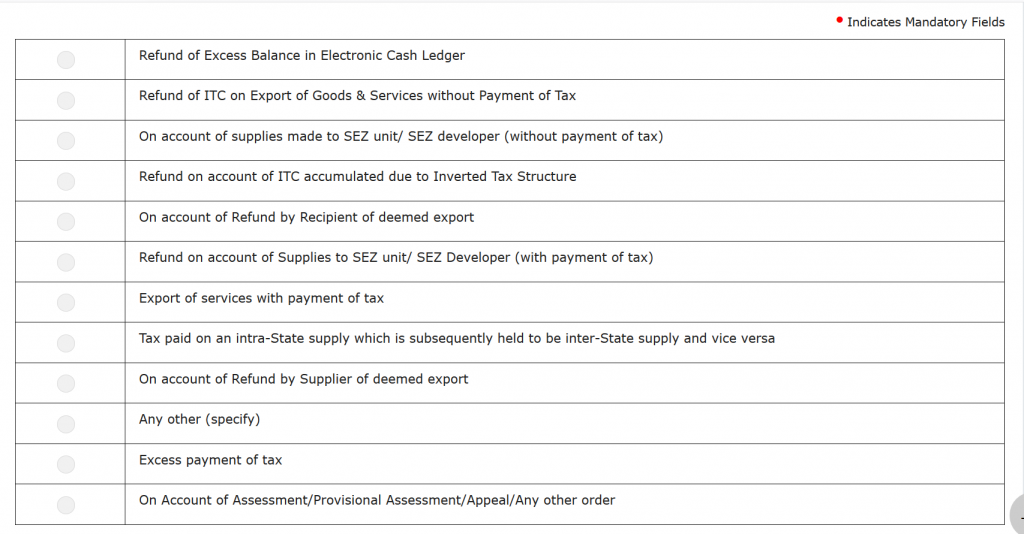

Under Application for Refund, you can see various options under for which refund can be claimed.

Kindly choose the appropriate option (depends on each case)

Once you select the appropriate option, you need to select months for which you’re going to claim refund. For ease, you can select multiple months/tax periods as well.

Please note: 1. Multiple tax period selection should be within the financial year only.

2. Application has to be filed chronologically for tax periods and in case refund application is not to be filed for any tax period, a declaration of No Refund Application is to be provided.

For example: July 2019 to September 2019 refund application cannot be filed till application or No refund application declaration is filed for any tax period prior to July 2019.

For demonstration purposes, we’re going to file refund of ITC on account of export of goods or services without payment of taxes.

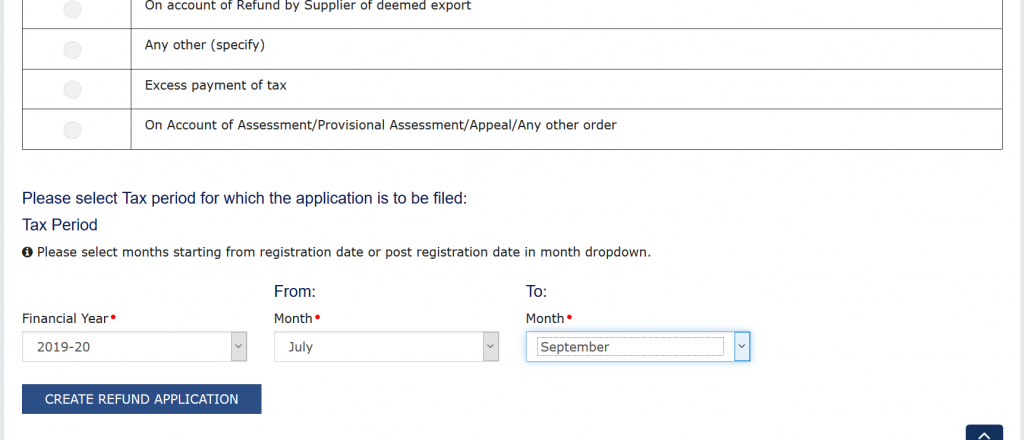

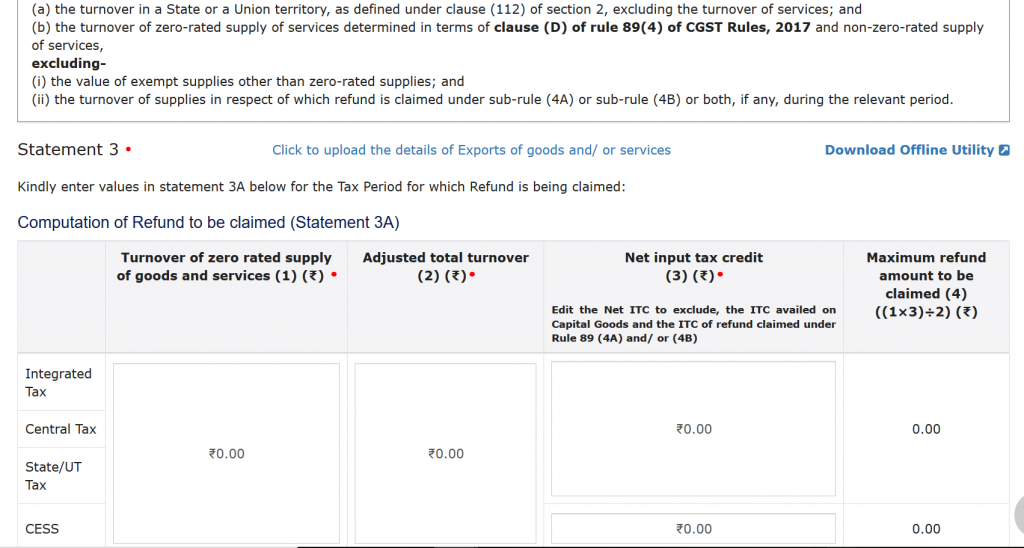

Step 4: Fill out Statement 3A

Enter the values of export turnover during the months for which the refund application is being filed.

Note : Adjusted Total Turnover will be same as column 1 where your business is 100% export. However, in case of any other component of turnover exists apart from export sales, the same will be deducted from the export sales and the balance figure will have to be declared here.

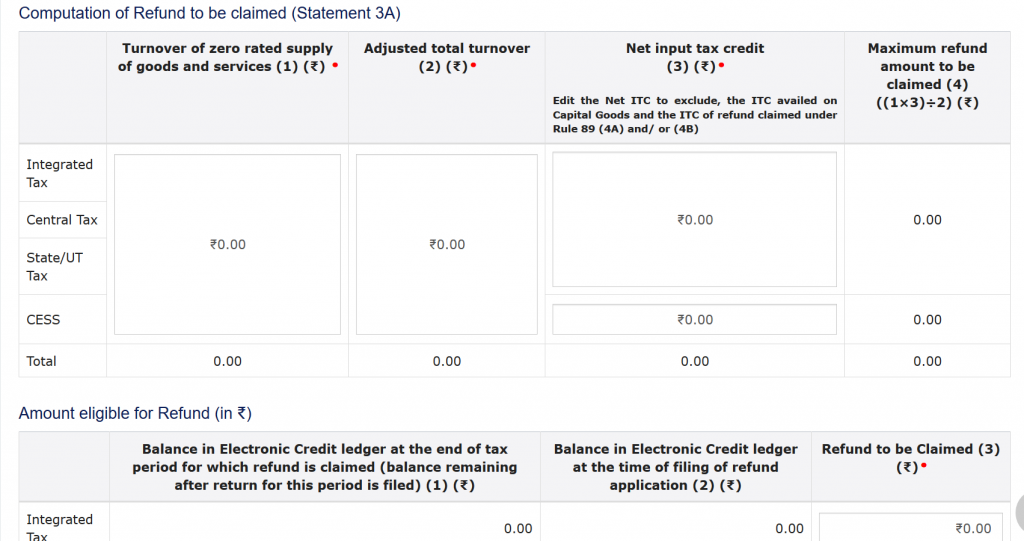

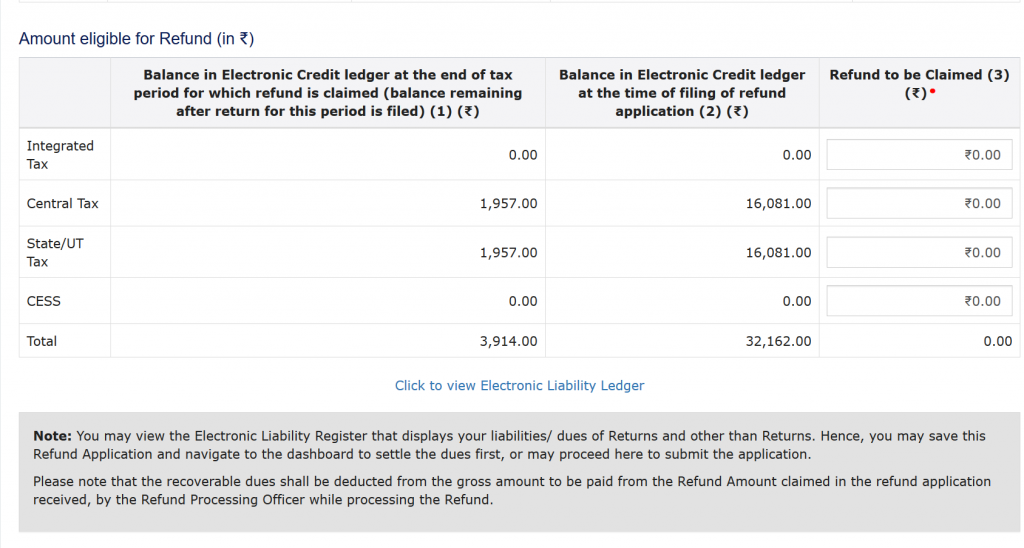

Step 5 : Fill out the amount eligible for refund under respective tax heads in column 3

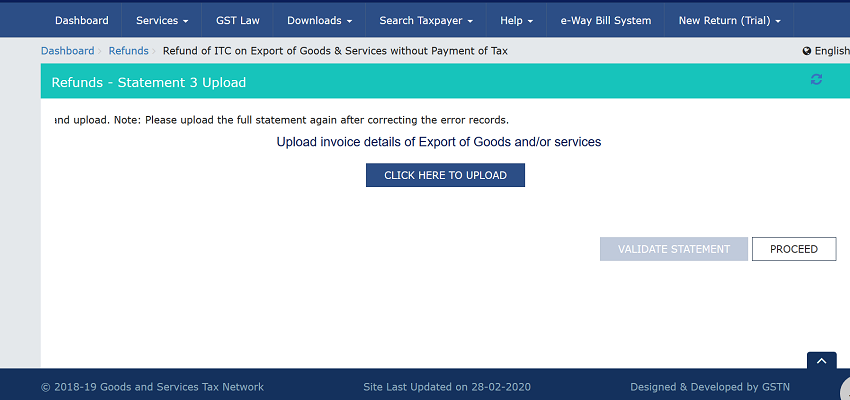

Step 6 : Download offline utility for Statement 3. The utility will be in excel format which needs to be filled.

Step 7 : Once the utility has been filled, validate it and a json file will be created which needs to be uploaded by clicking ‘Click to upload the details of exports of goods and/or services’.

Step 8 : Click on Validate statement and then proceed.

Step 9 : You will be redirected to RFD 01 application page. Kindly select the bank account number in which you would like to have your refund credited.

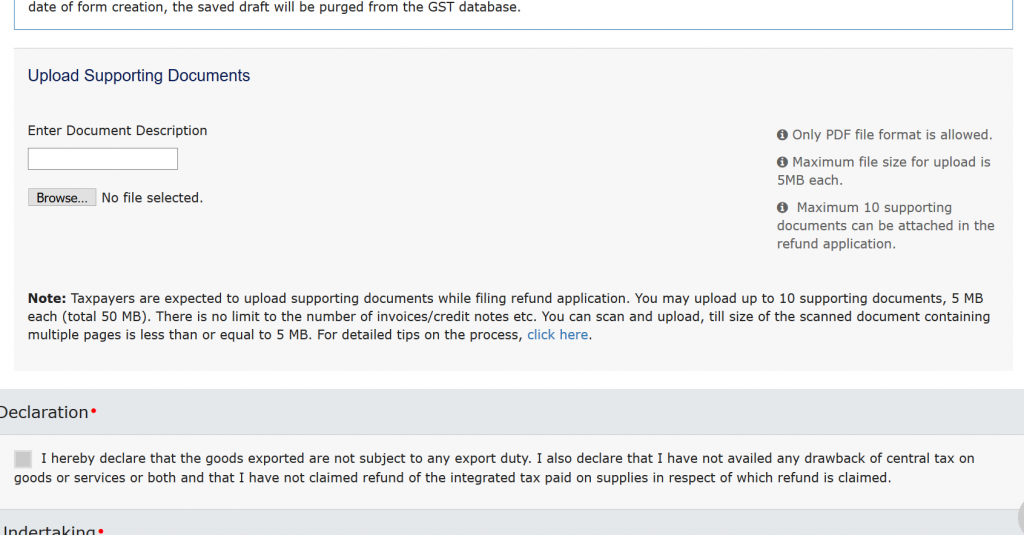

Step 10 : Kindly upload the attachment as given in Annexure A of Circular No. 125/44/2019 dated 18.11.2019 in the below tabs.

Note : Keep in mind the size restrictions to avoid hassles.

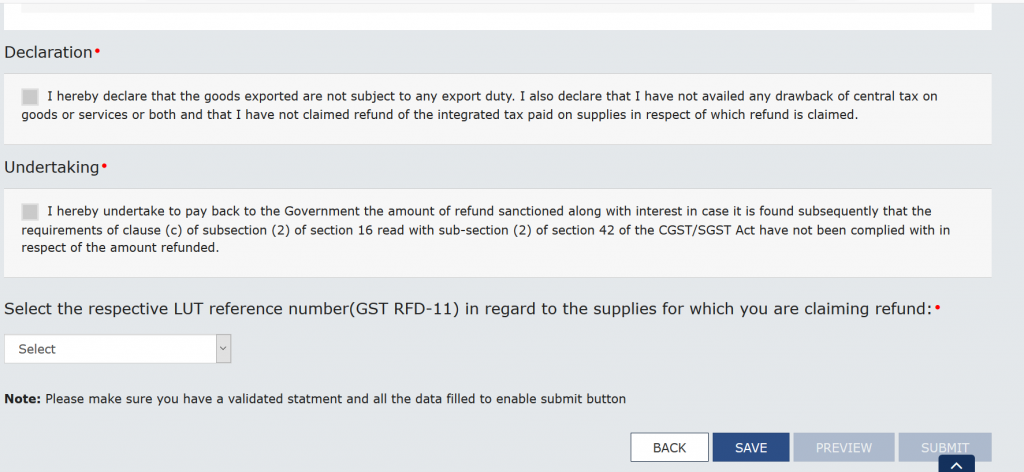

Step 11: Tick mark all the declarations to proceed further

Step 12 : Click on submit button and file RFD-01 by EVC or Digital Signature Certificate

Step 13 : Upon successful submission of RFD-01, an acknowledgment will be generated for your records.